Announcement of Discontinuation of Lightning FX and Launch of bitFlyer Crypto CFD

Thank you for using bitFlyer.

The Lightning FX service will be discontinued on Thursday, March 28th, 2024 at 6:00 pm (JST) and at the same time, our new service, bitFlyer Crypto CFD, will be launched.

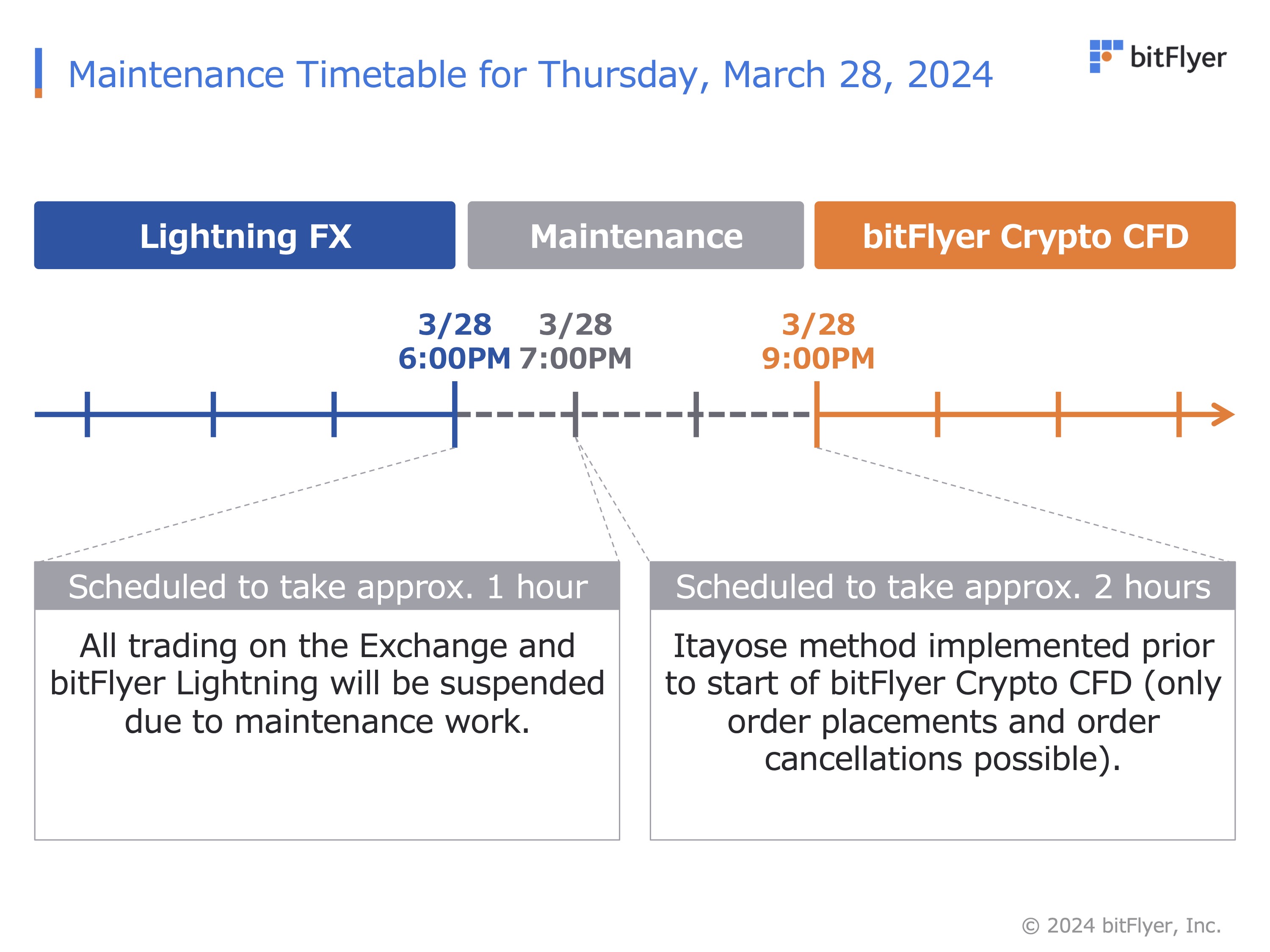

Due to the discontinuation of Lightning FX and the launch of bitFlyer Crypto CFD, a 3-hour maintenance will be performed on the following date and time to complete the changeover procedures.

bitFlyer Exchange and Lightning will be temporarily unavailable during the maintenance.

- Maintenance schedule: Thursday, March 28th, 2024, 6:00 – 9:00 pm (JST)

The following is planned during the maintenance schedule for Monday, March 28, 2024 6:00 - 9:00 pm (JST).

Since bitFlyer Crypto CFD has different product characteristics for "over-the-counter crypto asset derivatives trading" compared to Lightning FX, the Over-the-counter Crypto Asset Derivatives Trading (Document Requiring User Agreement) will be revised as of Monday, March 28, 2024 in conjunction with the launch of bitFlyer Crypto CFD.

Please click here for the revised Over-the-counter Crypto Asset Derivatives Trading (Document Requiring User Agreement).

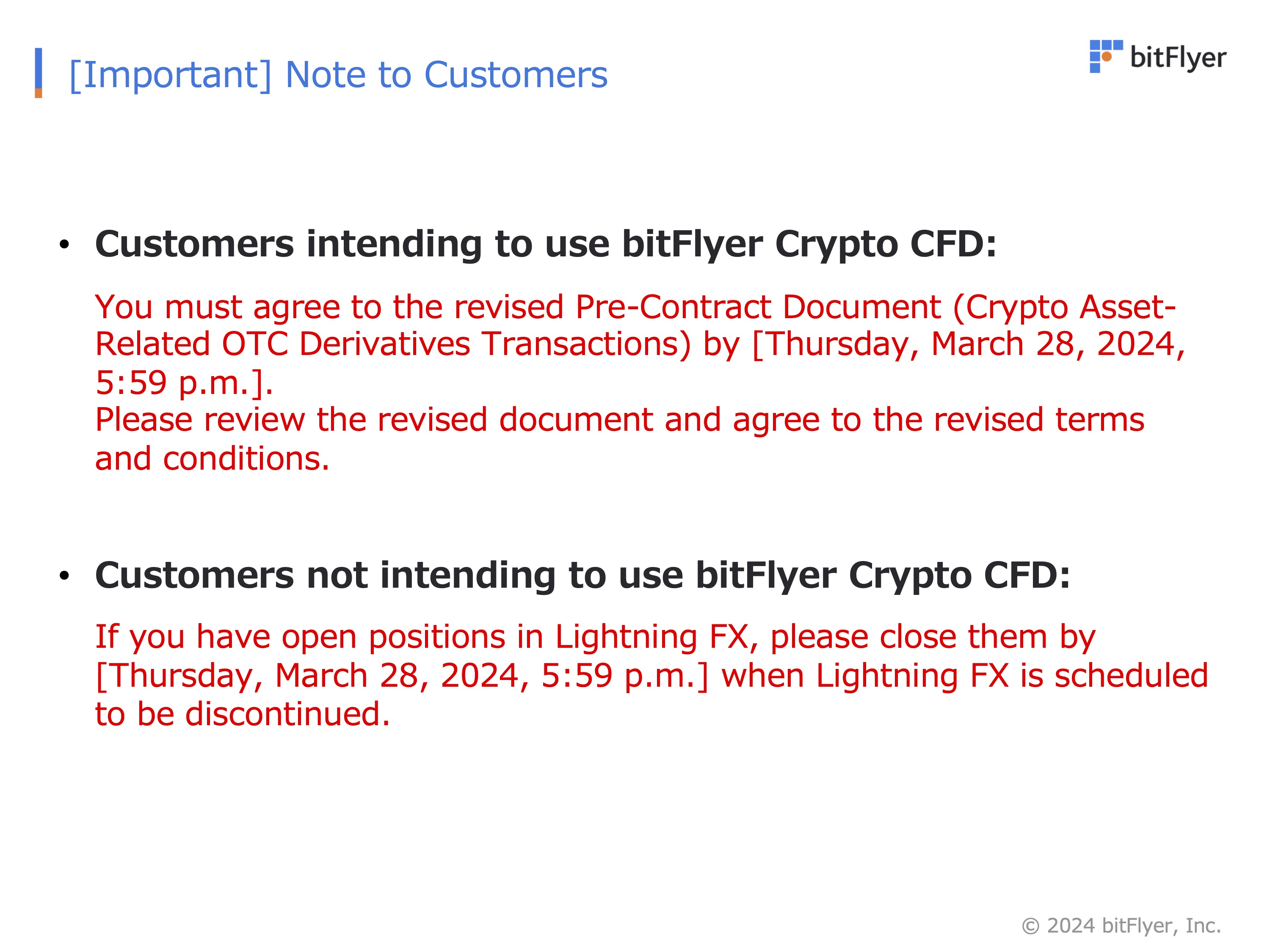

In order to use bitFlyer Crypto CFD, you must agree to the revised Over-the-counter Crypto Asset Derivatives Trading (Document Requiring User Agreement).

Customers who have open positions at the time of discontinuation of Lightning FX will be able to have them transferred to bitFlyer Crypto CFD without settlement or modification, as a partial contractual change, by agreeing to the revised Over-the-counter Crypto Asset Derivatives Trading (Document Requiring User Agreement) by Thursday, March 28th, 2024, 5:59 pm (JST), when Lightning FX is discontinued. At the time of the transfer, unrealized profits/losses on open positions in Lightning FX, including accumulated swap points and SFD, will be transferred to bitFlyer Crypto CFD as is.

Important: Request to Our Customers

Please read the following "Request to Our Customers" carefully and respond accordingly.

Please click here to see the revised Over-the-counter Crypto Asset Derivatives Trading (Document Requiring User Agreement).

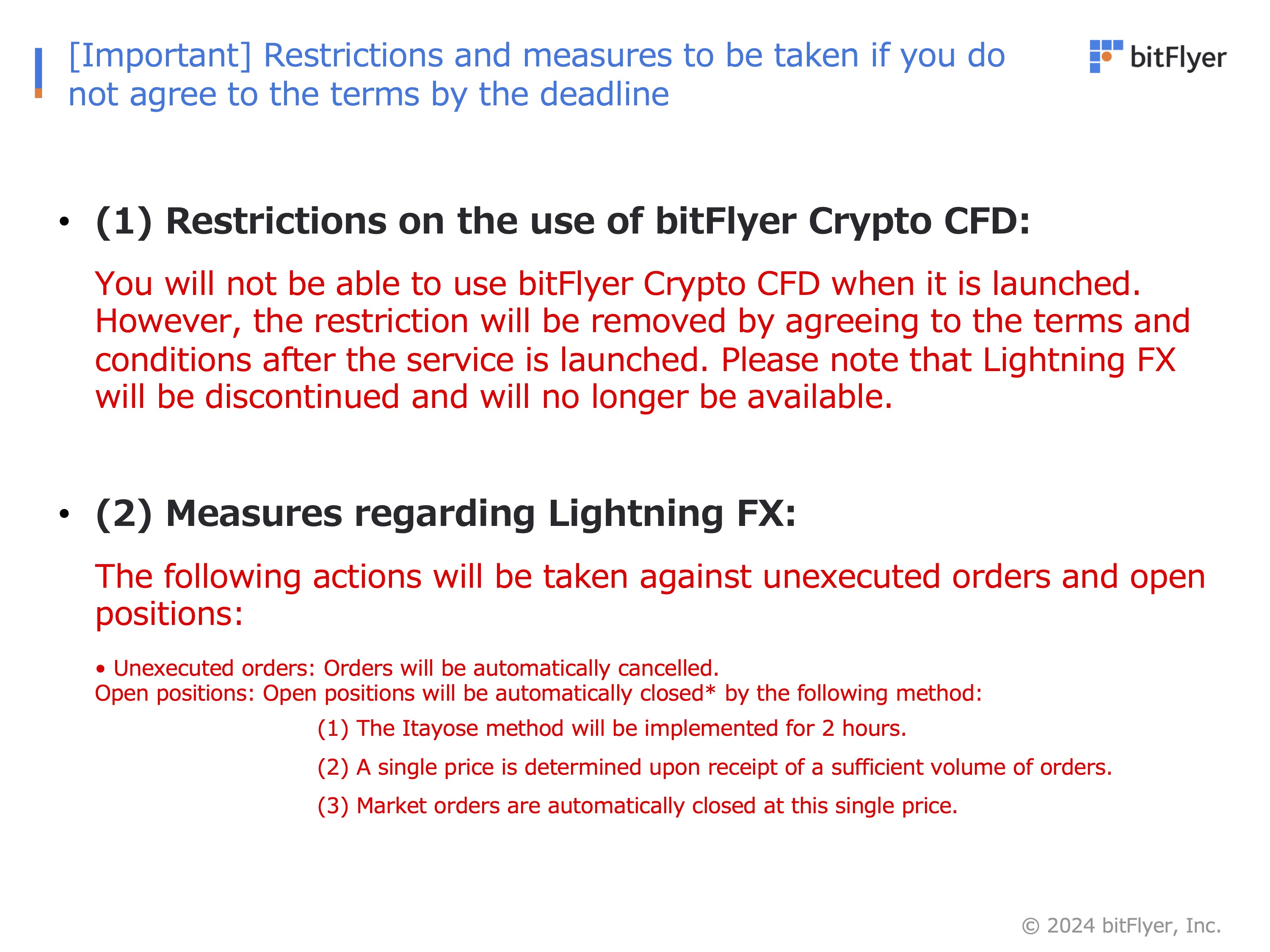

Important: Failure to Agree by the Deadline

Please be advised that if you do not agree to the revised Over-the-counter Crypto Asset Derivatives Trading (Document Requiring User Agreement) by Thursday, March 28th, 2024, 5:59 pm (JST), when Lightning FX will be discontinued, (1) restrictions will apply on the use of bitFlyer Crypto CFD, and (2) measures will be taken on unexecuted orders and unsettled open positions in Lightning FX.

Notes Regarding Unsettled Open Positions in Lightning FX

Please be aware that the following may occur in relation to the forced settlement of open positions in Lightning FX:

- Settlement of open positions at a price unintended by the customer

- Generation of realized profits/losses unintended by the customer

Key Differences Between bitFlyer Crypto CFD and Lightning FX

The key differences between bitFlyer Crypto CFD, which is a service for over-the-counter crypto asset derivatives trading, and Lightning FX are described below. For details, please refer to the Over-the-counter Crypto Asset Derivatives Trading (Document Requiring User Agreement) revised on March 28th, 2024.

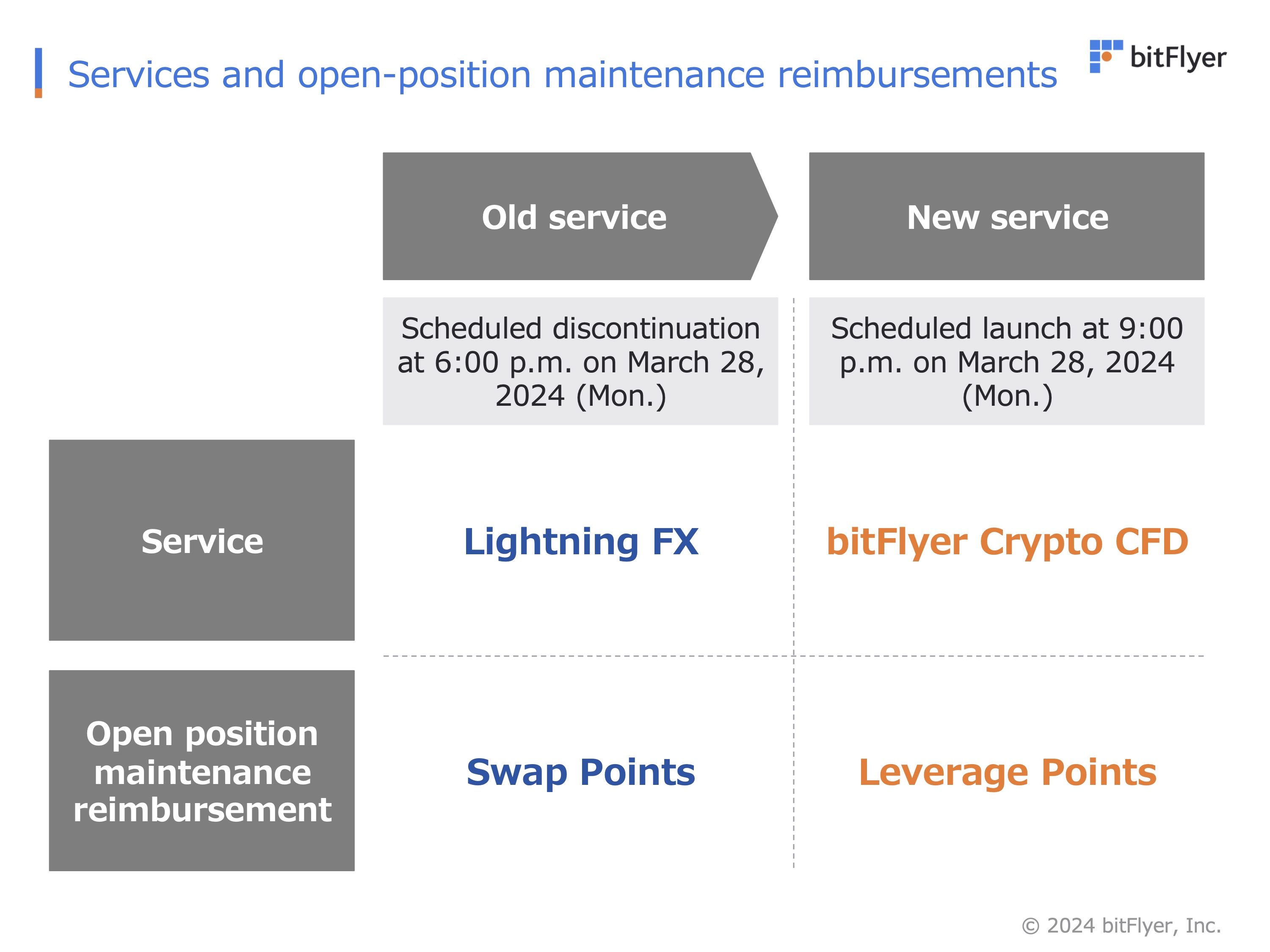

Naming for the service and naming for open position maintenance fee

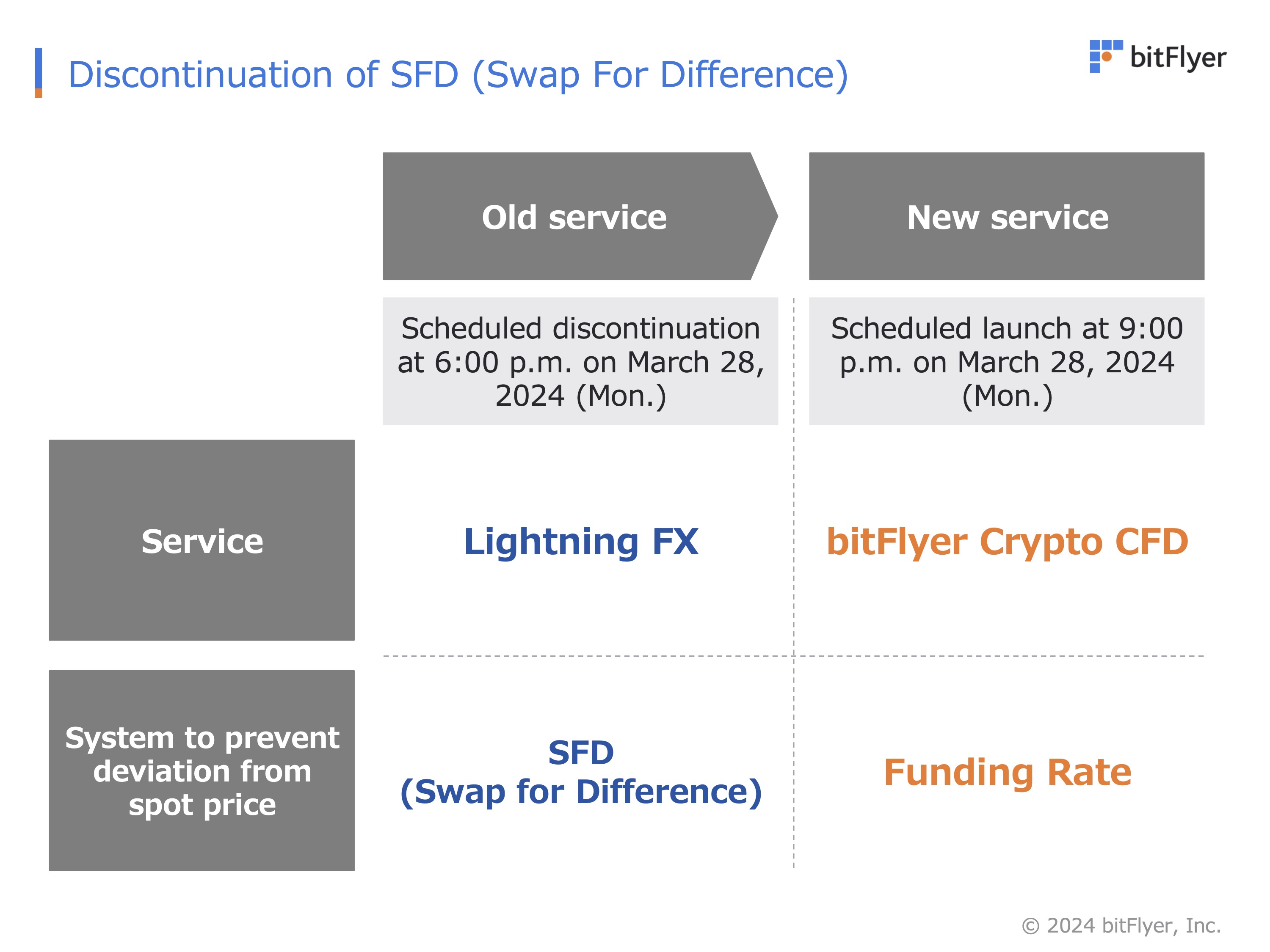

Discontinuation of the SFD (Swap For Difference) system

Introduction of the funding rate system

Introduction of the circuit breaker system (to prevent large divergences from spot trading prices)

Introduction of the rollover system (including the following two items)

- Introduction of a new margin maintenance ratio calculation method and sellout rules

- Introduction of leverage points

1. Naming for the service and naming for open position maintenance fees

Lightning FX will be discontinued as of 6:00 pm (JST) on Thursday, March 28th, 2024, and bitFlyer Crypto CFD will be launched at 9:00 pm (JST) on the same day.

There will be no change to the name of our exchange platform service "bitFlyer Lightning".

The naming for open position maintenance fees will be changed with the launch of the new service as follows.Leverage points will be collected during the rollover process at maturity as described further below, so the time of collection will be different from that of swap points.

2. Discontinuation of the SFD (Swap For Difference) system

Lightning FX introduced the SFD (Swap For Difference) system (*) to prevent divergence from the trading price of spot crypto assets.

*SFD (Swap For Difference) system: When the most recent Lightning FX trading price and the most recent Lightning Spot trading price (BTC/JPY) differ by 5% or more, SFD is generated on a contract-by-contract basis, and reflected as SFD profit or loss on the amount of money transferred at the time of settlement of an open position.

With the discontinuation of Lightning FX, the SFD (Swap For Difference) system will also be discontinued and the new “Funding Rate System” will be introduced in the new service, bitFlyer Crypto CFD, as described below.

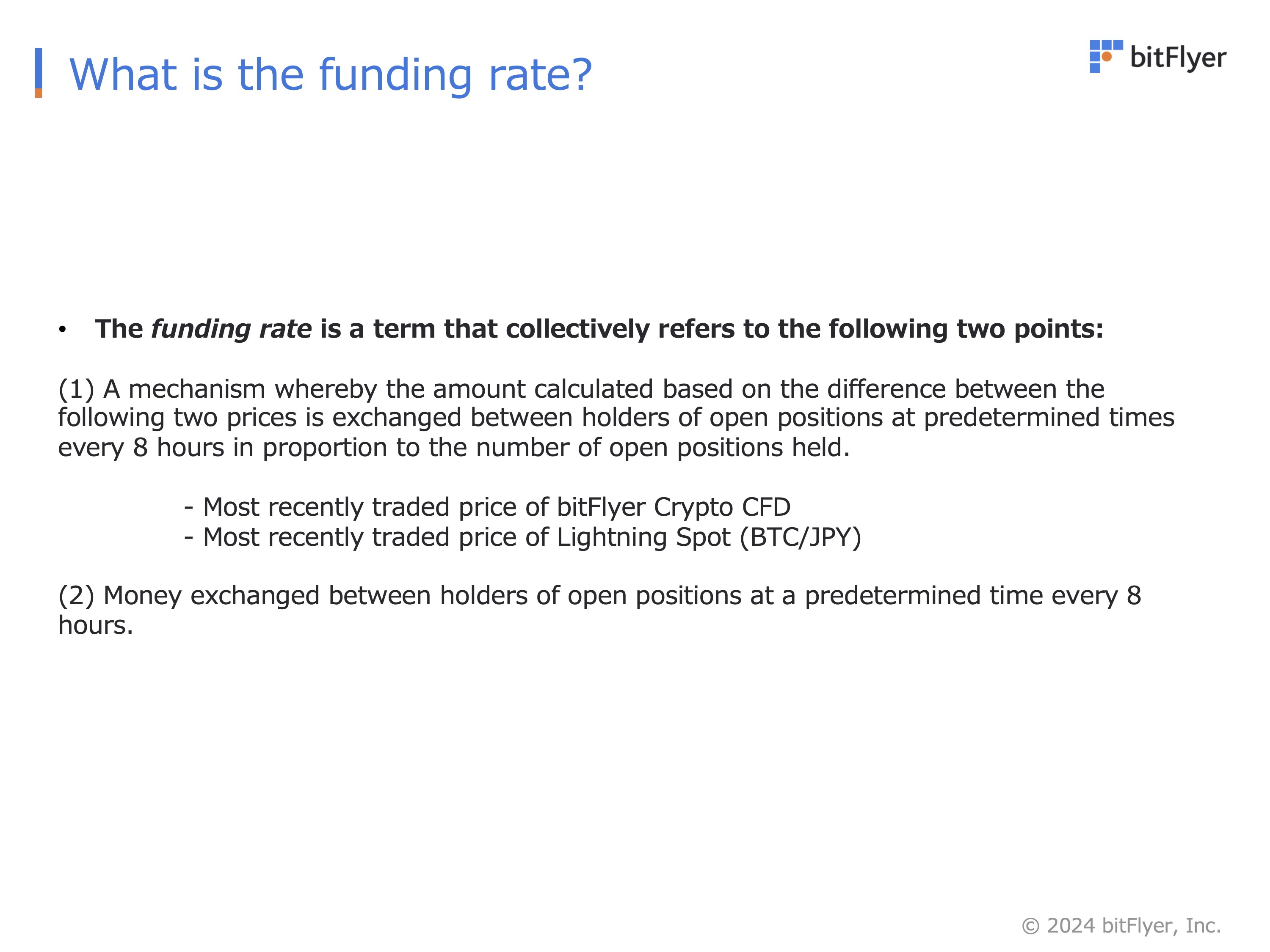

3. Funding Rate System

bitFlyer Crypto CFD, which will be available from Thursday, March 28th, 2024, 9:00 pm (JST), will introduce a funding rate system to prevent divergence from the spot trading price of crypto assets.

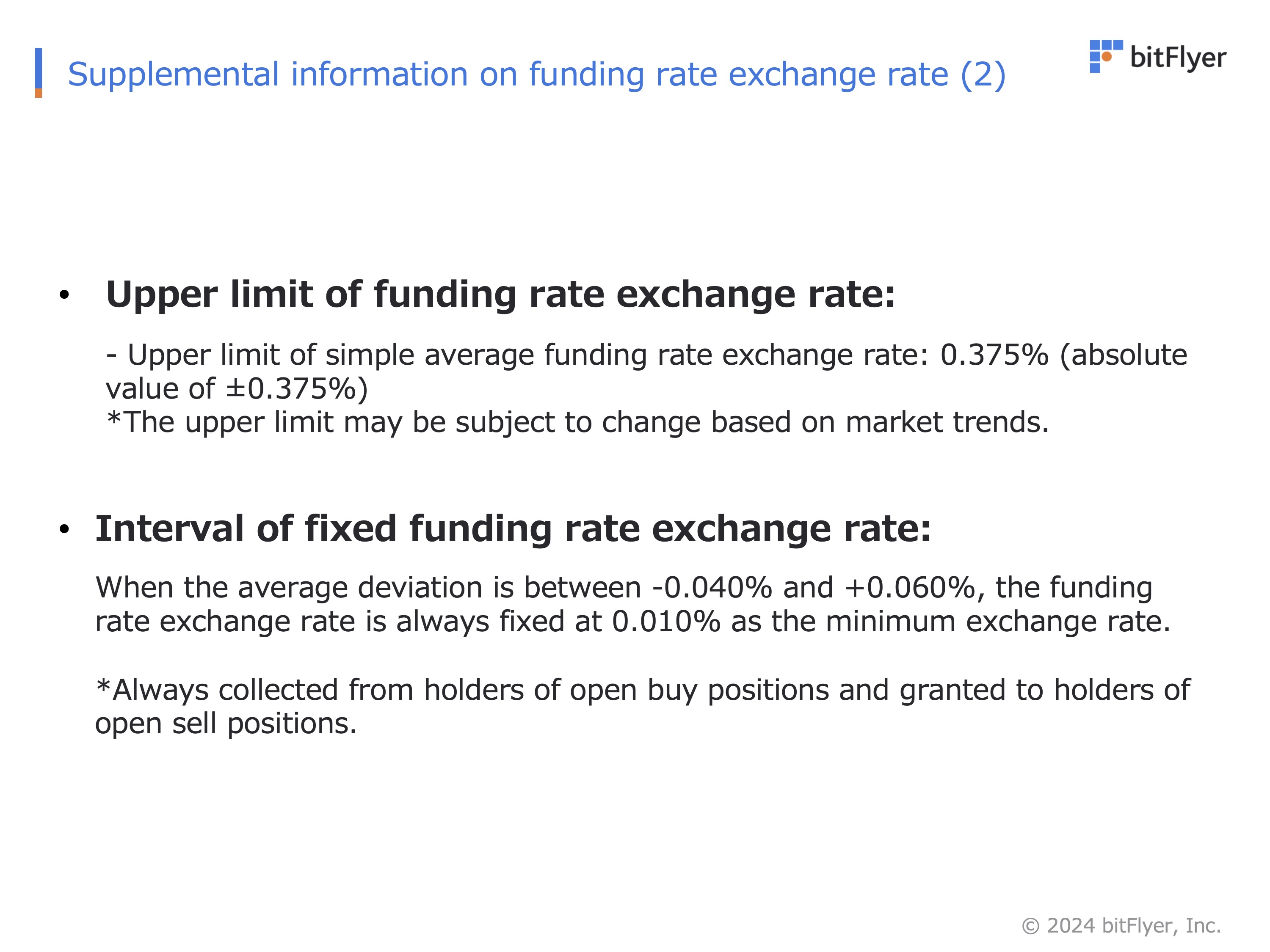

Our "funding rate" will be based on the following definitions.

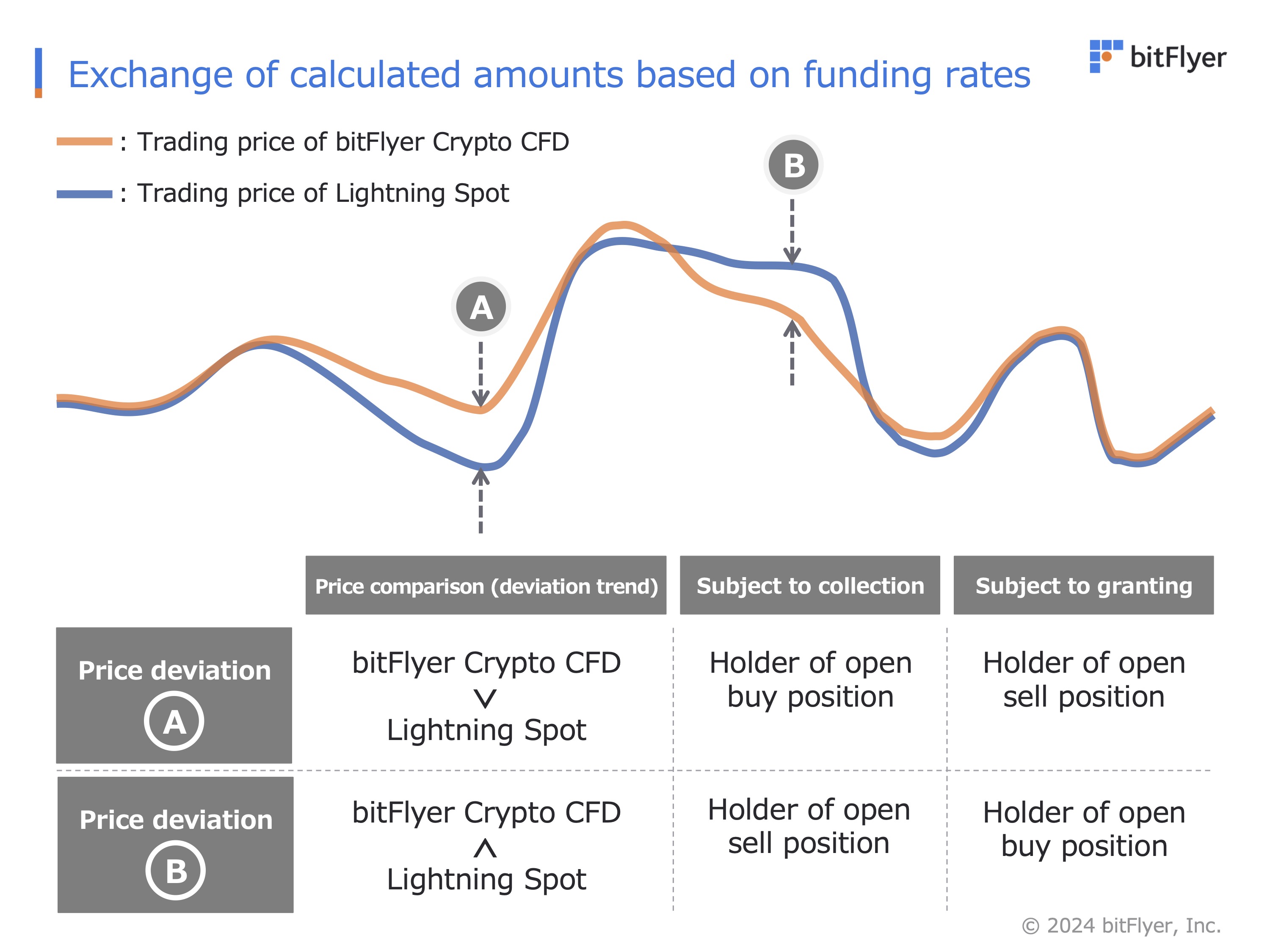

The transfer (collection or grant) of the amount calculated based on the funding rate will be conducted as follows, and the transferred amount will be reflected in the amount that is transferred at the time of settlement of an open position.

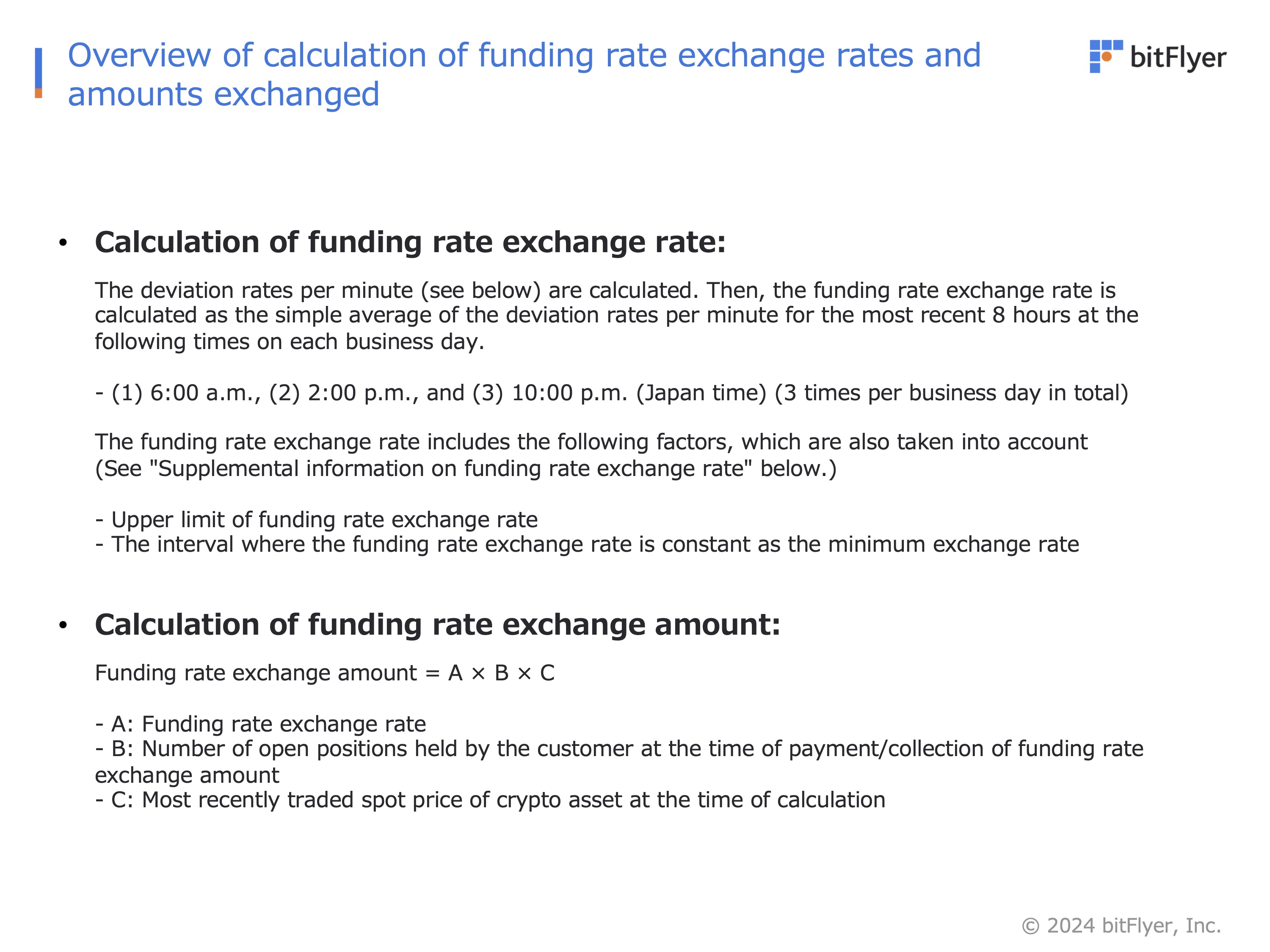

The amount transferred based on the funding rate is calculated as follows.

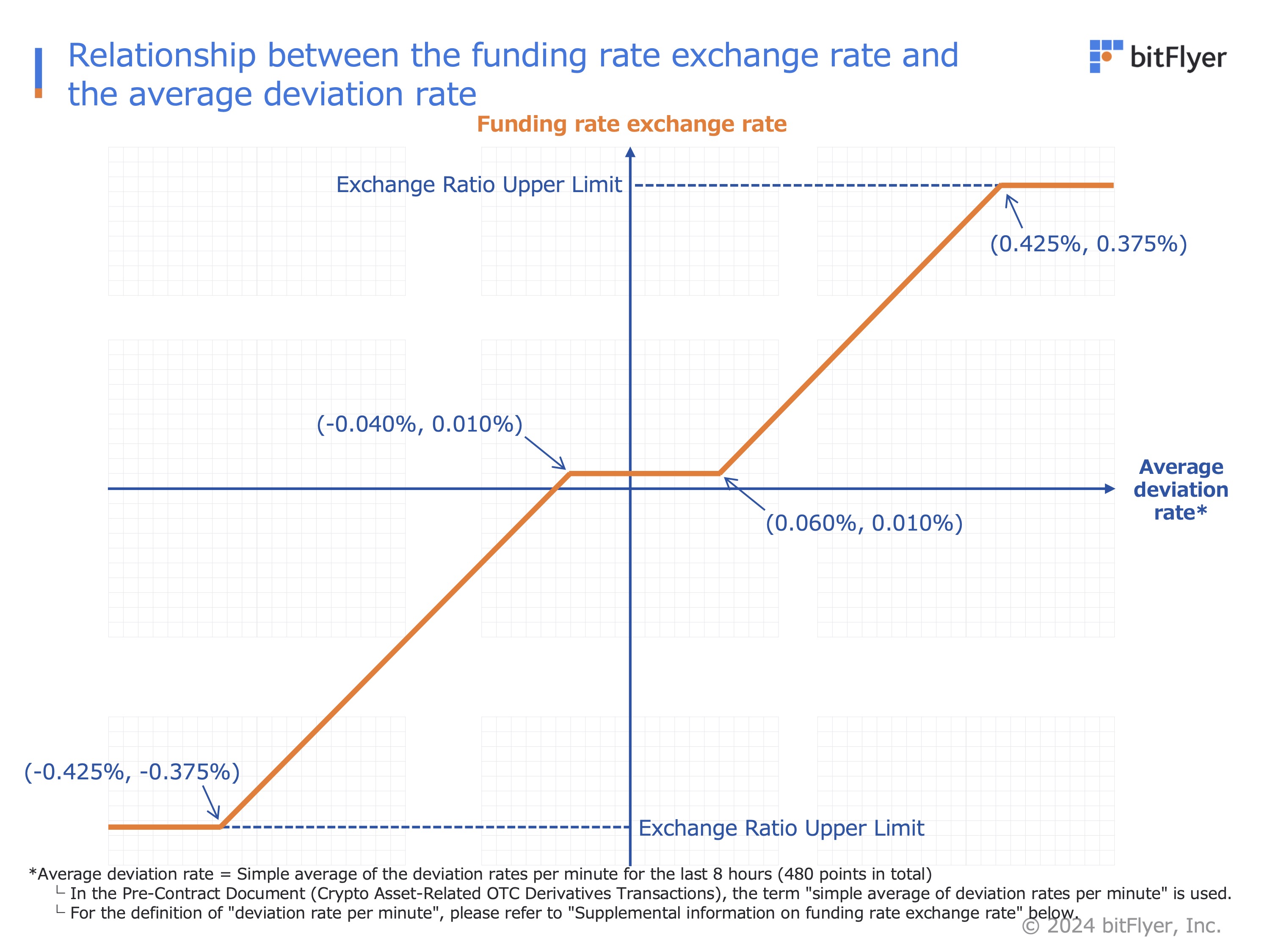

The relationship between funding rate and price divergence (average divergence) is shown below.

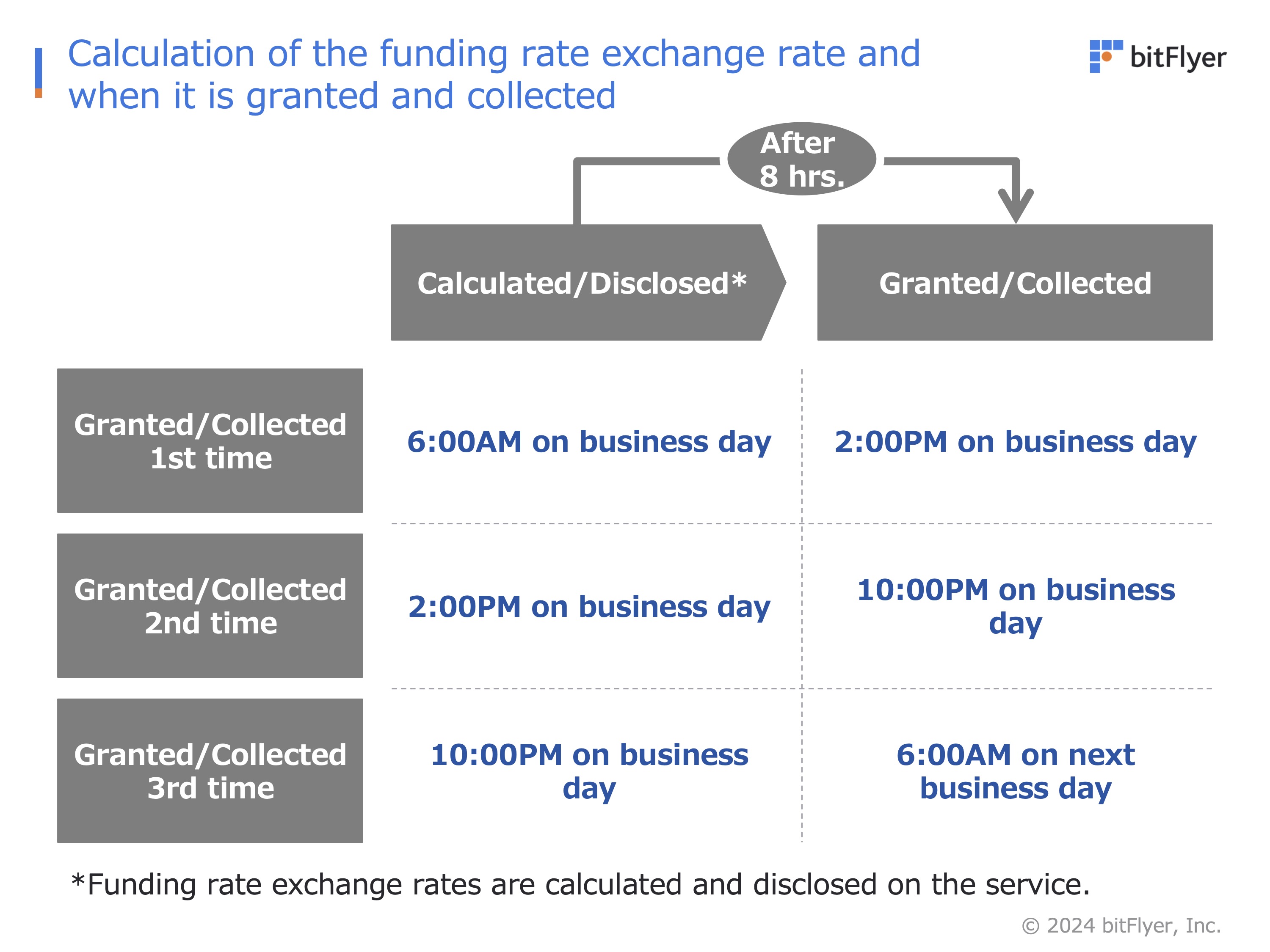

There is an 8-hour difference between the timing of execution of the following two items, and the specific schedule is as follows.

- Calculation of funding rate and publication on the service

- Transfer of funding rate amount between holders of open positions (collection or grant)

There is an 8-hour difference between the timing of execution of the following two items, and the specific schedule is as follows. - Calculation of funding rate and publication on the service - Transfer of funding rate amount between holders of open positions (collection or grant)

bitFlyer Crypto CFD, which will be available from 9:00 pm (JST) on Thursday, March 28th, 2024, will introduce a new circuit breaker system that will temporarily suspend trading based on the price divergence between the following two items in order to prevent significant price divergence from occurring.

- Trading price on bitFlyer Crypto CFD

- Crypto asset spot trading price

Lightning FX has a circuit breaker system in place to prevent sudden changes in trading prices due to erroneous orders, etc. bitFlyer Crypto CFD will have a circuit breaker system as well to prevent sudden changes in trading prices.

The following is an overview of the circuit breaker system, which is designed to prevent significant divergences from the spot trading price of crypto assets. Orders and order cancellations will be allowed while trading is temporarily suspended.

5. Introduction of the Rollover System

Lightning FX service was provided with an indefinite maturity period.

bitFlyer Crypto CFD, which will be launched on Monday, March 28, 2024, 9:00 pm (JST), will be offered as a "one-day maturity" and "deferred maturity" product, with reference to the following two items.

- The time of maturity is 6:00 pm JST on every business day (*) of bitFlyer

- The time of maturity of open positions maturing at 6:00 pm JST will be extended for one business day until 6:00 pm JST on the following business day.

*Business day refers to bitFlyer’s business days when bitFlyer Crypto CFD transactions can be made, which is, in principle, every day.

The rollover procedure to be followed upon the maturity of open positions (every business day at 6:00 pm JST) is outlined below.

In conjunction with the introduction of the above rollover system, bitFlyer Crypto CFD will use the margin maintenance ratio calculated based on the most recent spot trading price executed in Lightning spot trading as the denominator of the margin maintenance ratio when calculating and displaying the margin maintenance ratio for open positions held by a customer.

Margin amounts required for maintenance of bitFlyer Crypto CFD open positions are calculated based on the transaction amounts of said positions (Cabinet Office Order on Financial Instruments Business, etc. Article 117, paragraphs 42 and 52). Said transaction amounts are calculated (Cabinet Office Order on Financial Instruments Business, etc. Article 117, paragraph 44, item 1 and paragraph 54, item 1) based on the spot trading prices of the underlying cryptocurrencies (Financial Instruments and Exchange Act Article 2, paragraph 24, item 3-2 and paragraph 25, item 1) that are referenced by bitFlyer Crypto CFDs as index future transactions (Financial Instruments and Exchange Act Article 2, paragraph 22, item 2). The margin amounts required for maintenance of bitFlyer Crypto CFD open positions fluctuate in response to the most recently concluded spot trading prices of Lightning spots (BTC/JPY) and are used every business day at 6:00 p.m to determine the necessity of additional margin calls.

As mentioned above, the method of calculating the margin maintenance ratio is different from that of Lightning FX.

However, the calculation method for the valuation margin, which is the numerator of the margin maintenance ratio, is the same as the method used to calculate the valuation margin in Lightning FX.

In addition, there is no change in the method of applying sellout rules to open positions with insufficient margins 23 hours following a request for additional margin (at 5:00 pm (JST) on the next business day), but sellout rules will be applied immediately when the margin maintenance ratio reaches 50% based on the margin maintenance ratio calculated using the new method.

Furthermore, when the maturity of open positions is extended by one business day, the leverage points (*) for one business day will be calculated based on the number of open positions and the most recent trading prices on bitFlyer Crypto CFD, and the payment amount will be included in the valuation profit/loss of the relevant open position.

*In conjunction with the introduction of the rollover system, "swap point" payments, which were calculated and added to the valuation profit/loss of open positions at 12:00 am (JST) every business day on Lightning FX (Bitcoin FX/BTC-FX), will be discontinued, and "leverage point" payments at the time of rollover will be introduced.

An overview of leverage points is as follows.

The following points are posted on the Financial Services Agency's website.

・The inclusion of virtual currency exchange agencies in this list confirms only that, based on the concerned virtual currency exchange's explanation, the currencies they deal in meet the definition under fund settlement law.

・The Financial Services Agency and Treasury do not guarantee or endorse the value of these virtual currencies. Virtual currencies are not necessarily backed by assets.

・Please pay attention to the following points when trading in virtual currency.

(Notes concerning the use of virtual currency)

・Virtual currencies are not a "legal tender" with values guaranteed by the country, such as the Japanese yen or dollar. They are electronic data exchanged on the Internet.

・he price of virtual currency may fluctuate. There is a possibility of losing money as the price of the virtual currency may plummet, suddenly become worthless, and so on.

・The virtual currency exchange must register with the Financial Services Agency/Finance Bureau. Please check whether or not the exchange is a registered business owner if using their services.

・When trading virtual currency, please seek explanations from the exchange, fully understand the transaction details, and proceed at your own discretion.

・Discussions about virtual currencies and fraudulent coins are on the rise. Please be cautious of malicious and fraudulent businesses who are piggybacking on the use of virtual currencies and the development of the virtual currency exchange industry.

Virtual currency exchange registration list(PDF: 62KB)

Although we operate a service with the name “FX”, it is not a foreign currency exchange.

Although we use the term “exchange” on our services, they are not financial instruments exchanges as defined by the Financial Instruments and Exchange Act.

Disclaimer (please read carefully):

・Crypto assets are not a legal tender.

・Crypto assets may be used to settle a payment only in the event that the person receiving the payment agrees.

・Buying/selling crypto assets or exchanging them for other crypto assets are transactions which may result in losses incurred from price fluctuations of crypto assets. It is possible that the price of crypto assets declines due to influences from changes in balance of supply and demand, trends on prices of goods, currencies, and other markets, as well as changes in situation related to crypto assets.

・Trading with over-the-counter crypto asset derivatives may cause losses, because their trading price may fluctuate in either way due to influence from changes in balance of supply and demand of over-the-counter crypto asset derivatives on our platform as well as indirect influence from price changes of the crypto assets referred by those over-the-counter crypto asset derivatives.

・Over-the-counter crypto asset derivative trades are trades in which the notional amount, which is the product of the trading price and the open interest volume, can be larger than the amount of the margin deposit. Therefore, the amount of loss incurred may be larger than the amount of margin deposit if the notional amount fluctuates to a greater extent than the amount of margin deposit to your disadvantage due to changes in balance of supply and demand of over-the-counter crypto asset derivatives or price fluctuations of the crypto assets referred by the derivatives.

・The margin deposit size for over-the-counter crypto assets derivatives must be no less than 50% of the notional amount, while the notional amount must be no more than 2 times the margin deposit. (Both for individual customers .) More information can be found on our “What is bitFlyer Crypto CFD?” page.

・When making purchases or sales of crypto assets on Buy/Sell, or exchanging them for other crypto assets, customers bear the spread. The spread is the difference between the purchase and selling prices. The fees incurred when buying or selling crypto assets, exchanging them for other crypto assets or over-the-counter crypto asset derivatives as well as the calculation methods for the corresponding fees can be found on our Fees and Taxes page.

・Over-the-counter crypto asset derivatives are negotiated transactions between you and bitFlyer, Inc. which is the counterparty for you on those derivatives.

・You should thoroughly read and understand all of our documents that require user agreement. Trade at your own risk and judgment.