Account Creation Fee

| Account Creation and Maintenance Fee | FREE |

JPY Deposit and Withdrawal Fees

JPY Deposit Fees

| Bank Transfer Fees | Amount for Each Bank |

|---|---|

Quick deposit fee (Through SBI Sumishin Net Bank) | Free |

Quick deposit fee (Other than SBI Sumishin Net Bank) | 330 JPY (tax included) per deposit |

| Convenience store deposit fee | 430 JPY (tax included) per deposit |

JPY Withdrawal Fees

For customers of Mitsui Sumitomo Bank | Withdrawals less than 30,000 JPY 220 JPY (tax included) |

For customers of banks other than Mitsui Sumitomo Bank | Withdrawals less than 30,000 JPY 550 JPY (tax included) |

Trading Fee

Market Trading Fee

FREE

* Customers are responsible for the spread (the difference between the buy price and the sell price).

Exchange Fee

| Bitcoin | Execution amount x 0.01 ~ 0.15% (Base unit: BTC) |

bitFlyer Lightning Fee

Lightning Spot | Execution amount x 0.01% ~ 0.15% |

Details of Exchange and Lightning Spot Exchange Fee

* The trading fees are updated daily between 12:00 AM and 12:10 AM (JST).

* Trade volumes subject to this calculation include Buy/Sell Bitcoin, the Bitcoin Exchange, Lightning Spot, and bitFlyer Crypto CFD.

| Past 30 day volume | Exchange / Lightning Spot |

|---|---|

| Less than 100,000 JPY | 0.15% |

| 100,000 - Less than 200,000 JPY | 0.14% |

| 200,000 - Less than 500,000 JPY | 0.13% |

| 500,000 - Less than 1 million JPY | 0.12% |

| 1 million - Less than 2 million JPY | 0.11% |

| 2 million - Less than 5 million JPY | 0.10% |

| 5 million - Less than 10 million JPY | 0.09% |

| 10 million - Less than 20 million JPY | 0.07% |

| 20 million - Less than 50 million JPY | 0.05% |

| 50 million - Less than 100 million JPY | 0.03% |

| 100 million - Less than 500 million JPY | 0.02% |

| At least 500 million JPY | 0.01% |

bitFlyer Crypto CFD Exchange Fee

bitFlyer Crypto CFD Exchange Fee

FREE

(We will announce any changes 2 weeks in advance.)

bitFlyer Crypto CFD Leverage points

*Leverage point payments occur each time a rollover is conducted and the positions that were not offset by an opposing order by 6:00 pm (JST) within the same business day of bitFlyer are extended to 6:00 pm (JST) of the next business day.

| Buy position | The total of (the absolute value of open positions x 0.04% per day), (Base unit: JPY) |

|---|---|

| Sell position |

bitFlyer Crypto CFD Margins

| Margin rate (for individual accounts) | 50% (2x Leverage) to 100% (1x Leverage) |

|---|

bitFlyer Crypto CFD Funding Rate

The "Funding Rate" is defined as the mechanism by which money is transferred based on the amount calculated from the divergence between the bitFlyer Crypto CFD trading price and the Lightning spot trading price. This transfer is conducted in accordance with the customer's held position size, at the designated times every eight hours. If the bitFlyer Crypto CFD trading price exceeds the spot trading price of the crypto asset it references, funds are collected from the long position holders and granted to the short position holders. In the reverse scenario, funds are collected from the short position holders and granted to the long position holders.

An overview of the way the transfer amount is calculated based on the funding rate can be found below.

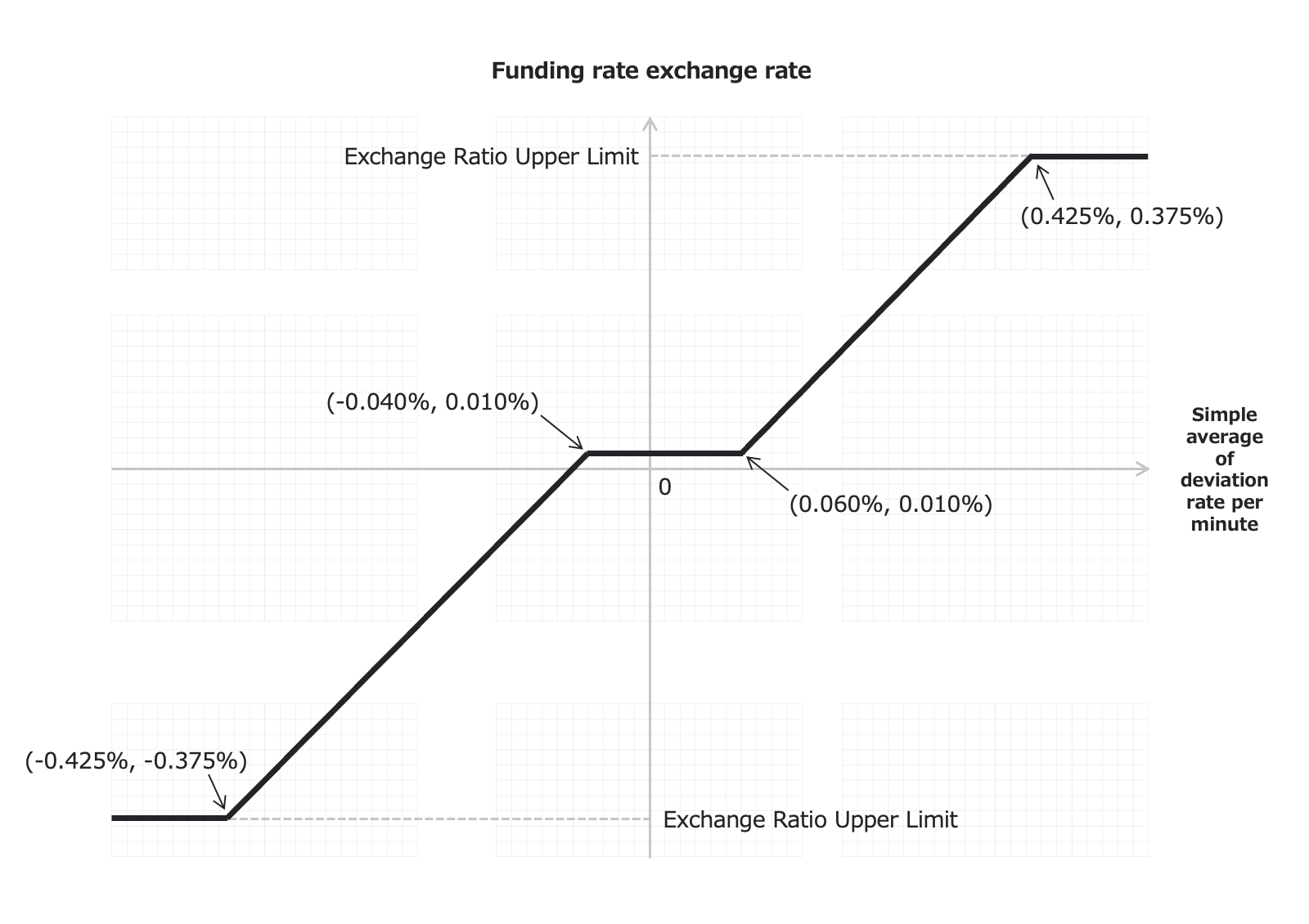

Calculation method of the funding rate transfer ratio

Calculation of the minute-by-minute divergence rate (see below). The funding rate transfer ratio is then calculated as the simple average of the minute-by-minute divergence rate over the most recent 8-hour period at the following times on each business day.

- (1) 06:00, (2) 14:00, and (3) 22:00 (3 times per business day in total in JST)

The funding rate transfer ratio includes the following factors, which shall also be taken into account.

(See "Additional information on the funding rate transfer ratio" below.)

- The upper limit of the funding rate transfer ratio

- The interval where the funding rate transfer ratio is constant as the minimum transfer ratio

Calculation method of the funding rate transfer amount

Funding rate transfer amount = A x B x C

- A: Funding rate transfer ratio

- B: The volume of open positions held by the customer at the time of payment/collection of the funding rate transfer amount

- C: The last Spot trading price of the crypto asset at the time of calculation

Find additional information on the funding rate transfer ratio below.

Definition of the minute-by-minute divergence rate

Bid/ask price (either the Impact Bid Price or Impact Ask Price, whichever is closer to the Most Recent Spot Trading Price) ÷ Most Recent Spot Trading Price - 100%

If the Most Recent Spot Trading Price is between the Impact Bid Price and Impact Ask Price, the Minute-by-Minute Divergence Rate is set to zero.

Definition of impact ask price

The expected volume-weighted average executed price of a transaction on bitFlyer Crypto CFD, assuming the purchase of exactly 1 BTC-CFD, based on the order situation on bitFlyer Crypto CFD at the time when the minute-by-minute divergence rate is calculated.

Definition of impact bid price

The expected volume-weighted average executed price of a transaction on bitFlyer Crypto CFD, assuming the sale of exactly 1 BTC-CFD, based on the order situation on bitFlyer Crypto CFD at the time when the minute-by-minute divergence rate is calculated.

Upper limit of the funding rate transfer ratio

Upper limit of the simple average funding rate transfer ratio: 0.375% (±0.375% absolute value)

*The upper limit is subject to change by bitFlyer in consideration of market trends

Fixed interval of the funding rate transfer ratio

When the average divergence is in the range of -0.040% to +0.060%, the funding rate transfer ratio is always fixed at 0.010% as minimum transfer ratio.

*The funding rate is always collected from long position holders and granted to short position holders.

The relationship between the funding rate transfer ratio and price divergence (average divergence rate) is as shown below.

Unit of Each Crypto Asset Transaction and Minimum Order Size

| Bitcoin | 0.00000001 BTC (=1 satoshi) |

| Ether (Ethereum) | 0.00000001 ETH |

| Ether (Ethereum Classic) | 0.00000001 ETC |

| Litecoin | 0.00000001 LTC |

| Bitcoin Cash | 0.00000001 BCH |

| Monacoin | 0.00000001 MONA |

| Lisk | 0.00000001 LSK |

| XRP | 0.000001 XRP |

| Basic Attention Token | 0.00000001 BAT |

| Stellar Lumens | 0.0000001 XLM |

| NEM | 0.000001 XEM |

| Tezos | 0.000001 XTZ |

| Polkadot | 0.00000001 DOT |

| Chainlink | 0.00000001 LINK |

| Symbol | 0.000001 XYM |

| Polygon | 0.00000001 MATIC |

| Maker | 0.00000001 MKR |

| Zipangcoin | 0.0001 ZPG |

| Flare | 0.000001 FLR |

| Shiba Inu | 1,000 SHIB |

| Palette Token | 0.00000001 PLT |

| The Sandbox | 0.00000001 SAND |

| Axie Infinity | 0.00000001 AXS *Minimum order size is 0.0001 AXS |

| Decentraland | 0.00000001 MANA *Minimum order size 0.01 MANA |

| Immutable | 0.00000001 IMX *Minimum order size is 0.001 IMX |

| ApeCoin | 0.00000001 APE *Minimum order size is 0.001 APE |

| Chiliz | 0.00000001 CHZ *Minimum order size is 0.01 CHZ |

| DAI | 0.00000001 DAI *Minimum order size is 0.001 DAI |

| Render Token | 0.00000001 RNDR *Minimum order size: 0.001 RNDR |

| The Graph | 0.00000001 GRT *Minimum order size: 0.01 GRT |

| Avalanche | 0.00000001 AVAX *Minimum order size: 0.0001 AVAX |

| DOGE | 0.00000001 DOGE *Minimum order size: 0.01 DOGE |

| ELF Token | 0.00000001 ELF *Minimum order size: 0.01 ELF |

| Zipangcoin Platinum | 0.000001 ZPGPT *Minimum order size: 0.0001 ZPGPT |

| Zipangcoin Silver | 0.000001 ZPGAG *Minimum order size: 0.001 ZPGAG |

| Mask Network | 0.00000001 MASK *Minimum order size: 0.001 MASK |

| Polygon Ecosystem Token | 0.00000001 POL * Minimum order size is 0.01 POL |

| Pepe | 0.00000001 PEPE * Minimum order size is 640 PEPE |

※ If the minimum purchase unit is entered as the order quantity, and the amount obtained by multiplying the corresponding sale price by the sale quantity is less than 1 JPY, the quantity must be changed to a quantity that is at least 1 JPY.

Transaction Fee for Each Crypto Asset and Minimum Withdrawal Size

| Bitcoin | 0.0004 BTC |

| Ether (Ethereum) | 0.005 ETH |

| Ether (Ethereum Classic) | 0.005 ETC |

| Litecoin | 0.001 LTC |

| Bitcoin Cash | 0.0002 BCH |

| Monacoin | FREE |

| Lisk | 9.7 LSK |

| XRP | FREE |

| Basic Attention Token | 5 BAT |

| Stellar Lumens | FREE |

| NEM | 3 XEM |

| Tezos | 0.1 XTZ |

| Polkadot | 0.1 DOT |

| Chainlink | 1 LINK |

| Symbol | 2 XYM |

| Polygon | 19 MATIC |

| Maker | 0.02 MKR |

| Flare | 1 FLR |

| Shiba Inu | 320,000 SHIB |

| Palette Token | 40 PLT |

| The Sandbox | 13 SAND |

| ELF Token | FREE |

| Render Token | 2.2 RNDR |

| Polygon Ecosystem Token | 26.0 POL * Minimum withdrawal size is 0.17 POL |

| Pepe | 964,000 PEPE * Minimum withdrawal size is 6,400 PEPE |

※ Deposits and withdrawals of the following crypto assets are currently not available: ZPG, MANA, AXS, IMX, APE, CHZ, DAI, GRT, AVAX, DOGE, MASK, ZPGAG, ZPGPT. RNDR is available for withdrawals only. Deposits are not accepted.

bitWire

bitWire Fee

FREE

Information on domestic tax treatment for crypto assets

For more information on tax treatments for Japanese domestic crypto asset transactions, please consult your local tax office or qualified tax advisor for further information.

The Japanese tax authorities' current stance on crypto assets are summarized below. However, this may change at any time. bitFlyer is not responsible for any tax declarations, tax burdens, or damages incurred by customers or third parties.

Capital gains received by individual customers from trading Over-the-counter derivatives of crypto assets are generally subject to taxation as miscellaneous income. However, the tax treatment may shift to business income tax depending on the amount of capital gains and compliance with the requirements for maintaining transaction-related accounting records and documents.

Purchasing goods and services in crypto assets are subject to consumption tax. The displayed prices of goods and services on our website include consumption tax.